Kino bikes / BLOG / Around the bike / The 4 helps for purchasing an electric bike 2024 (individuals)

Kino bikes / BLOG / Around the bike / The 4 helps for purchasing an electric bike 2024 (individuals)

Article Categories

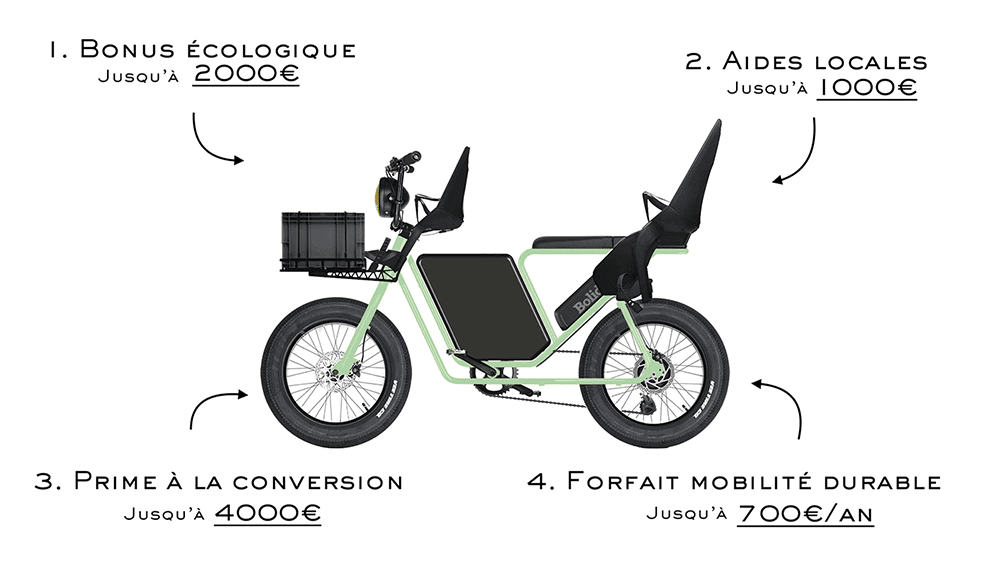

Also called “bicycle bonus”, its allocation is established under means test, which were increased in 2023.

As of January 1, 2024, the “bicycle bonus” system will now make it possible to finance purchasing a second-hand bike (purchased from a professional seller)

This aid is capped between 150€ and 2€ depending on the situation.

Le ecological bonus can be combined with the conversion bonus as well as with other aid from local authorities.

This aid is intended for adults who live in France or for companies with an establishment in France.

It concerns the purchase of a new bicycle (or used from a professional), including electrically assisted bicycles.

Not everyone can benefit from this assistance only once.

Criteria for individual applicants:

Criteria for applicants as a company:

Characteristics of the eligible bike:

Amount of state aid for the purchase of bicycles with or without electrical assistance:

Bicycles without electrical assistance:

“Traditional” electrically assisted bicycles:

The amount of aid is capped at 40% of total cost purchase of the bike.

The request must be made on the site: https://www.primealaconversion.gouv.fr

The conversion bonus, or scrappage bonus, is financial assistance for the purchase or rental of a clean vehicle in return for scrapping an old gasoline or diesel vehicle or, since August 2022, the purchase of an electric bike is integrated into the system.

To simplify the article, we will only talk about electric bikes here.

Attention ! If the purchase takes place between July 26, 2021 and August 14, 2022, the rules are different.

This aid is intended for adults living in France who wish to scrap a polluting car.

Characteristics of the purchased/rented bike

Characteristics of the vehicle to be destroyed

The amount of the premium varies depending on your situation:

*You benefit from an additional premium if you live or work in a low mobility emission zone (ZFE) and your local authority has paid you aid to buy or rent an electrically assisted bicycle.

The amount of the additional premium is identical to the aid paid by the local authority, within the limit of €1.

The aid is capped at 40% of the acquisition cost

The request must be made on the site: https://www.primealaconversion.gouv.fr

Apart from national aid, subject to income conditions, there are regional or even municipal schemes which make it possible to recoup the purchase of an electric bike.

Their amount and conditions of allocation vary from one city/region to another.

To help you we have integrated this tool “MesAidesVélo” which lists and updates local aids 👇

The sustainable mobility package (FMD) is a new financial system to support employees in the private sector and public service agents for their home-work travel.

The “sustainable mobility package” is a system optional : his The terms and conditions (amount and criteria for awarding costs) are determined by the company.

When the employer decides to take charge of the FMD, he must benefit from it, under the same conditions, all the employees concerned.

Volunteers in civic service are not eligible for FMD payment.

In the private sector: Up to 700€/year* + €100 public transport subscription reimbursement.

In the audience : 200 € / year, for a minimum of 100 days per year by bike and/or carpooling.

Newsletter

Sign up to receive our newsletter!